By Ron William, CFTe, MSTA

A recent industry event featuring a keynote discussion on “Unmooring expectations” challenged mainstream thinking on the latest rise in bond market yields, raising concerns about its potential “licence to kill” unprepared and leveraged market players.

Global government bond losses are on course for the worst year since 1949 and investor sentiment plummeted to its lowest since the 2008 GFC. In fact, this year’s bond tumble threatens credit events and potential liquidation of the world’s most crowded trades, including bets on USD and US tech stocks, according to BofA.

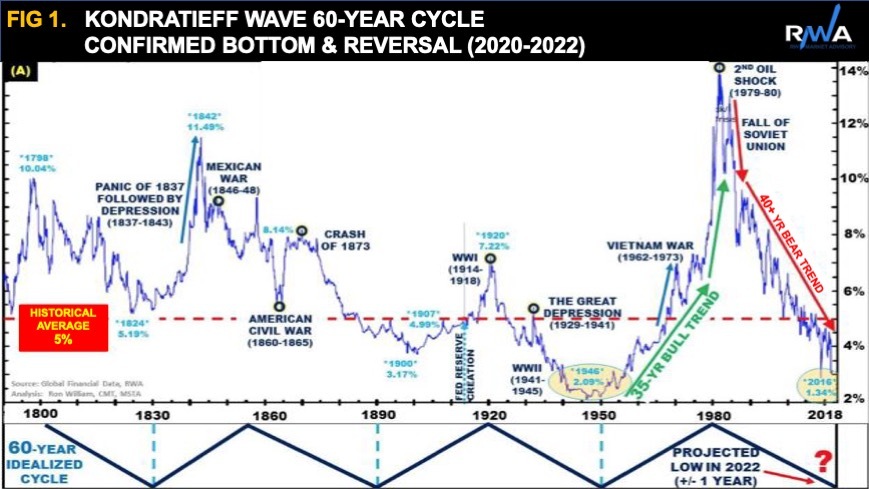

Recall that I had forewarned of a long-term bottom and reversal in US10Y, between 2020-2022, pressured by an overdue Kondratieff wave averaging 60 years (Figure 1). Harvard professor Dr. Joseph Schumpeter wrote in the 1930s, “The Kondratieff Wave is the single-most important tool in economic forecasting”.

Here and now, the new structural rise on US10Y reversed a 40-year bear trend and threatens its 5% historical threshold (Figure 2), which spans over 200 years (Figure 1) and coincides with a tactical resistance level. This likely creates a new market regime, characterised by waves of volatility, with a tentative high-low watermark of 5-3%.

The BofA’s Move Index, the bond market’s equivalent of the VIX for stocks, is already elevated back into COVID spike levels, stressing the US govt. liquidity (Figure 3).

It most certainly signals another financial calamity ahead!

Harley Bassman, founder of the MOVE Index and managing partner at Simplify Asset Management, believes short-term rates are close to peaking, but that long-term bonds remain vulnerable to the triple threats of convexity, illiquidity and duration.

Cracks are widening across the ocean, as BOE gives local funds a countdown to fix problems, before support is withdrawn. Joseph Wang, former senior trader at the Federal Reserve argues that illiquidity in the UK gilt market might be a harbinger for other sovereign bond markets around the world.

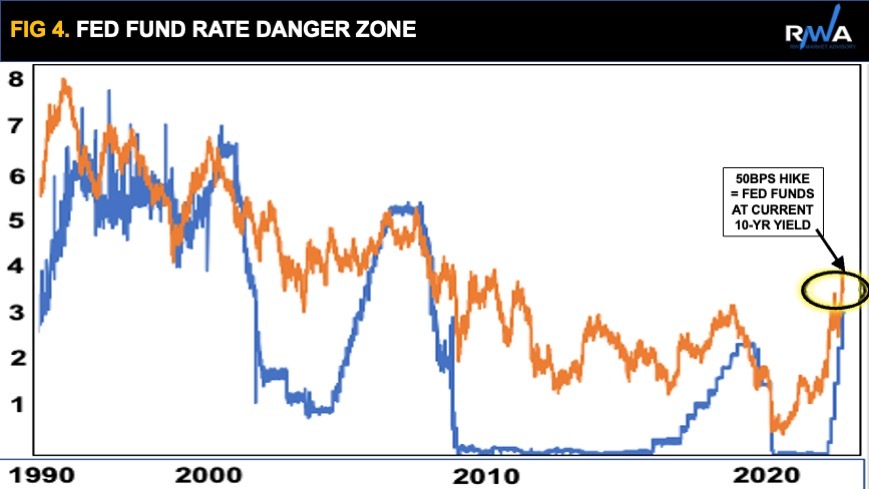

Meanwhile, all eyes remain on the Fed for a much-awaited “pivot”. But will they move as soon as expected? Interestingly, the near-term forward spread between the Fed Fund Rate and US10Y is now -50bps (Figure 4), meaning a hike of anything higher, at the November meeting would be a purposeful inversion of the yield curve which it recommended to use as a gauge for recession risk.

Note, a research paper published by Fed economists debated the so-called “near-term forward spread” has more predictive power. The forward spread recently hit its widest since 2002. Eurodollar futures show traders expect the Fed to be cutting rates by the end of 2024. Until then, it is likely best to position for a relatively more hawkish Fed and BOE vs. a more dovish ECB. Our K-wave model signals a ‘winter’ season ahead, as part of the pending “Minsky risk”. Resilience is key.

By Ron William, CFTe, MSTA

Ron is a market strategist and educator/mentor with more than 20 years of experience working for leading macro research and institutional firms, producing tactical research and trading strategies. He specializes in global, multi-asset, top-down framework, grounded in behavioural technical analysis, driven by cycles based on the “Roadmap” signature model of veteran market technician Robin Griffiths, published in his book “Mapping the Markets.”

Ron also applies a “market & mind” approach at IntensiChi, using the latest techniques in behavioural-risk models and neuroscience sourced from expert groups. He further supplements with mentoring/coaching, trained by the International Coaching Federation (ICF), and teaches a regulatory-approved masterclass in Applied Behavioural Science, with investment, private banks and CFA Societies.

As part of his current institutional market advisory firm (RWA), Ron’s primary work acquired global industry recognition as winner of “Best FX Research” in 2020. Financial media programs and industry publications regularly feature his market insights, including “Is the big cycle about to turn?”, predicting the 2020 crash and alerting the “Minsky paradigm” of 2020 H2-2022.

Responses