Are investors suffering from the “Lollapalooza” effect?

Legendary investor Charlie Munger, the vice-chairman of Bershire Hathaway, gave a famous speech in 1995 to Harvard University students about “The Psychology of Human Misjudgement.” It featured 25 cognitive (or behavioural) biases that cause misjudgement. A grand-finale bias of this list featured the “Lollapalooza” effect; where psychological biases synergise together, compounding exponentially, thereby building asymmetric event risk.

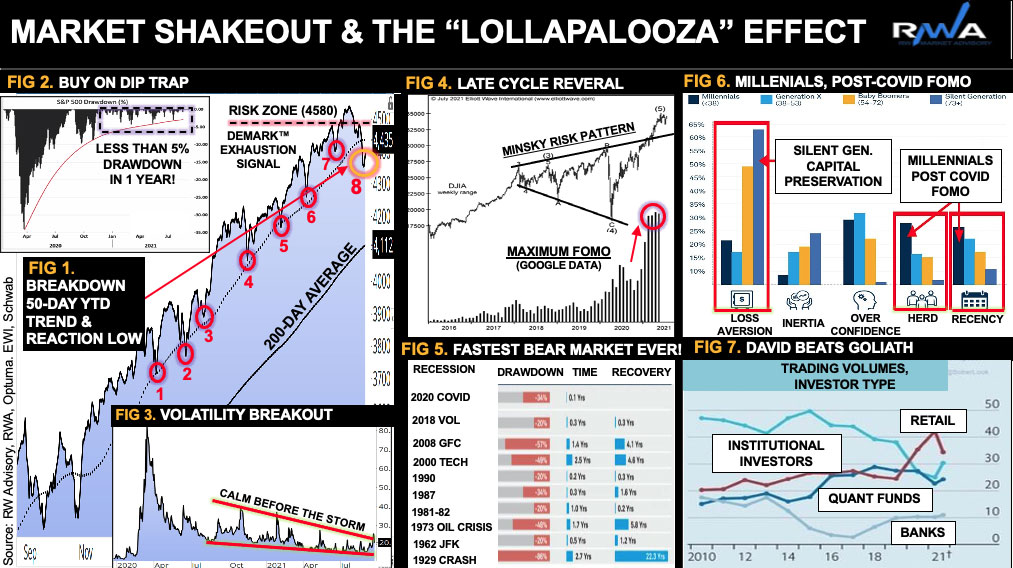

Indeed, the elevated volatility, as correctly predicted by our last article “Calm before the storm” – warned of mean-reversion from historic behavioural and market extremes. S&P500’s latest breakdown under its tactical 50-day average and reaction low is a viable trend reversal signal (Figure 1).

Even so, many bulls are continuing to proclaim “buy on the dip!” Will it be another opportunity, or could this alternate to a dangerous game of “catching the falling knife”. Alas, the pavlovian conditioning is naturally strong with less than 5% drawdown in one year (Figure 2).

Watch the VIX volatility breakout to continue higher (Figure 3), into the month of October, with our cycle models signalling risk of lighting striking again into yearend. According to Google data analytics, the strongest bias was FOMO (fear of missing out), a hybrid of loss aversion and overconfidence (Figure 4).

Both produce the sine-wave extremes of a market’s fear-greed cycle. FOMO originated from the crisis-opportunity of the 2020 pandemic crash, which served as the fastest bear market recovery ever! (Figure 5). Partly for this reason, many investors faced a rollercoaster panic experience into, then out of, the V-shape bottom.

Moreover, behavioural client data from Charles Schwab, highlights that younger and new, first-time traders, experienced variations of the same theme via herding and recency bias (Figure 6). Many enjoyed the best part of a linear bull-trend, marked by “Rock’n’roll” investment returns, hitting triple digits across frothy markets such a Tech, MEME stocks and Crypto.

Retail traders, akin to the biblical story of David beating Goliath, based on historic liquidity volume, led by mob-like psychology, amassing strength and will in greater numbers (Figure 7). Veteran investors often say the worst trading experience is making money in easy conditions and worse for the wrong reasons.

Why so? A traditional bear market is less forgiving, often punishing with zero-tolerance and a much sharper learning curve. Recall the average papa bear triggers a quantum drop of 30-50% and most importantly for a time duration of 2-3 years.

In such cycles, a successful market & mind approach is demanded, for relative performance enhancement, risk optimization, grounded by a systematic process. Munger recommends we “Think slowly. Take a breather…[and avoid] knee-jerk decisions!”

Responses